HODLing – The Power of Patience

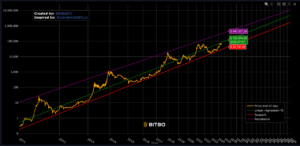

Let’s talk HODLing—Bitcoin’s golden rule, short for “Hold On for Dear Life.” It’s not about flipping coins for quick cash; it’s about planting a seed and watching it grow into a forest. Why does this work? Because Bitcoin’s deflationary to its core—only 21 million will ever exist, and every halving squeezes the supply tighter. Unlike fiat, where printing more cash means your savings buy less tomorrow, Bitcoin’s scarcity means its value climbs as more people want in. Holding BTC isn’t just waiting; it’s riding a wave that gets bigger over time. This is a strategy that turns patience into power, aligning perfectly with Bitcoin’s design to reward the steady, not the speedy.

Real-world wins tell the tale. Take the pizza guy: back in 2010, Laszlo Hanyecz famously spent 10,000 BTC on two Papa John’s pies—worth pennies then, about $41. If he’d HODLed instead, that stash would’ve ballooned to over $600 million by 2021’s peak. Or think of Erik Finman, a teen who tossed $1,000 into Bitcoin in 2011 at $12 a coin. He held on, and by 2017, his haul was worth millions—enough to skip college and build a future his way. These aren’t fairy tales; they’re proof of what happens when you trust Bitcoin’s long game. It’s not about striking it rich overnight—it’s about seeing that a little BTC today could mean a lot more tomorrow, whether it’s for a kid’s tuition or a comfy retirement.

Saving BTC isn’t a losing battle; it’s a growing nest egg that could one day unlock big goals without a lifetime of grind. This isn’t just theory; it’s a mindset shift. Fiat trains us to spend fast—blow that paycheck before inflation steals it. Bitcoin says ride it out. Early adopters didn’t cash out at the first bump; they saw the vision—a world where money gains muscle, not flab. You don’t need to be a Wall Street shark to win here; you just need patience. That 0.1 BTC you grab today might not feel like much, but as halvings stack up and adoption spreads, it could stretch further than dollars ever will. It’s not about timing the market—it’s about trusting the math and letting time do the heavy lifting.

HODLing’s the power move fiat can’t match. It’s why Bitcoin’s not just an investment—it’s a rebellion against a system that punishes savers and rewards reckless printing. Those pizza coins and teen millionaires show what’s possible: fewer BTC needed over time means your wealth builds, not burns. Patience is your ticket to a future where money finally fights for you, not against you.