Time Preference – Thinking Long-Term

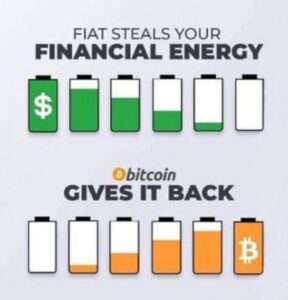

Ever feel like you’re stuck in a hamster wheel, spending every dollar the second it hits your account? That’s fiat’s game, and it’s got a name: high time preference. It’s when you’re pushed to think short-term—blow that cash on takeout or a new phone because, deep down, you know it’ll buy less next week. Inflation’s the puppet master here: a dollar today might get you a coffee, but in ten years, it’s barely a sip. Fiat’s endless printing—trillions pumped out in a crisis—means your money’s on a timer, losing value faster than you can save it. It’s a trap: spend now or watch it evaporate. This system doesn’t just drain your wallet; it steals your future, keeping you scrambling to survive the present.

Bitcoin crashes that party with low time preference—a fancy way of saying it rewards looking ahead. With only 21 million coins ever, and halvings slicing the new supply every four years, Bitcoin’s built to get rarer and stronger over time. Hold onto it, and its value doesn’t just sit still—it climbs as demand grows. This flips the script: instead of rushing to ditch your BTC before it’s “worthless,” you’re incentivized to save, knowing it could buy more later. Think of it like planting an apple tree—you don’t eat the seeds; you wait for the harvest. This is a breath of fresh air: your money’s not a ticking bomb but a growing asset, nudging you to plan for a house, a kid’s education, or a peaceful retirement, not just next month’s rent.

How does Bitcoin pull this off? It’s all about incentives. Fiat’s a hot potato—spend it fast, or inflation burns you. Bitcoin’s a fine wine—let it age, and it gets better. Say you stash 0.5 BTC today. In fiat world, $500 might barely cover groceries in a decade. But with Bitcoin’s deflationary edge, that 0.5 BTC could stretch to a car or more as its scarcity drives value up. This isn’t about getting rich quick; it’s about building something lasting. It’s a shift from survival mode to strategy mode. You’re not just dodging bills; you’re crafting a future where your savings don’t shrink but stretch, giving you room to dream beyond the next paycheck.

This time preference switch is personal—it’s empowerment in your hands. Fiat’s high-speed churn keeps us hooked on debt and instant gratification, a cycle that fattens banks and governments while we scrape by. Bitcoin breaks that chain, handing you the reins. No central bank’s devaluing your stash; no politician’s printing it away to bail out buddies. It’s a system where individuals win by thinking long-term—HODLing BTC becomes a quiet rebellion against a world that’s trained us to live day-to-day. It’s a chance to stop running and start building, knowing your effort today pays off tomorrow, not evaporates in some bureaucrat’s budget.

Bitcoin’s not just money—it’s a mindset. It’s hope for the single mom who wants her kid to have more, the retiree who’s tired of shrinking pensions, or anyone who’s felt crushed by fiat’s grind. Low time preference means planning over panicking, thriving over surviving. It’s a system that lifts you up, not holds you down—empowering individuals, not faceless institutions. This is Bitcoin’s gift: a future where your patience turns into power, and long-term thinking becomes your edge.