Lesson 5: The Golden Age of Gold-backed Currency

The 19th century marked the height of the gold-backed currency system, as the global adoption of the gold standard allowed for unprecedented economic stability and growth. During this period, the world saw the rise of powerful colonial empires, the expansion of international trade, and the development of modern financial institutions. The gold standard played a central role in these developments, providing a stable monetary system that allowed for easy cross-border transactions and the establishment of a global economic network.

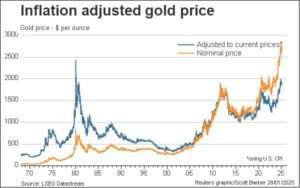

One of the most significant advantages of the gold standard was its ability to ensure stable prices and low inflation. Under the gold standard, the money supply was tied to the amount of gold in circulation, which meant that it could not be easily manipulated by governments or central banks. This system helped prevent inflationary pressures, as governments were restricted from simply printing money to finance wars or domestic programs. The scarcity of gold acted as a natural check on the expansion of the money supply, ensuring that prices remained relatively stable over time.

This stability fostered economic growth, as businesses and individuals could plan for the future with confidence, knowing that the value of money would not fluctuate dramatically. This allowed for long-term investments in infrastructure, technology, and industry. The gold standard also helped build trust in the financial system, as individuals and businesses had confidence that their money would retain its value. People could save and invest without fear that inflation would erode the purchasing power of their wealth.

As the global economy expanded, the interconnectedness of nations grew, and the gold standard facilitated this process. Since many countries had adopted the same standard, it became easier for nations to trade with one another. Exchange rates between currencies were fixed, which eliminated the risk of sudden currency fluctuations that could disrupt trade. Merchants, traders, and financial institutions could conduct business across borders with a high degree of certainty, knowing that their money would be accepted worldwide.

During this time, the gold standard also played a critical role in the era of colonialism and global trade expansion. European powers, such as Britain, France, and Spain, used their gold-backed currencies to finance their empires and expand their influence around the world. The stability of the gold standard allowed these nations to engage in large-scale trade and investment, fueling the growth of industries like shipping, manufacturing, and agriculture. The global reach of these empires created a vast network of trade and commerce, with gold as the common currency that connected distant regions of the world.

The era of gold-backed currency was also marked by the establishment of major financial institutions. Central banks, such as the Bank of England, played a crucial role in managing the gold reserves that backed their countries’ currencies. These institutions acted as intermediaries between the government and the public, regulating the money supply and ensuring that the gold standard was maintained. The stability of these financial systems allowed for the growth of stock markets, bonds, and other forms of investment, laying the foundation for modern global finance.

Despite its many advantages, the gold standard was not without its challenges. One of the primary limitations of the system was its reliance on the physical supply of gold. If a country’s gold reserves were depleted, it could face economic instability, as it would be unable to issue more money to meet the needs of the economy. Moreover, the scarcity of gold could sometimes constrain economic growth, as the money supply could not expand rapidly enough to accommodate the growing demands of an industrializing world.