Lesson 7: The Introduction of Fiat

The idea of fiat money—currency not backed by any physical commodity—has been around for centuries. However, it wasn’t until the modern era that fiat currency began to replace commodity-backed money on a global scale. The first examples of fiat money can be traced back to China during the Tang Dynasty in the 7th century, where the government issued paper money that was backed by nothing more than the emperor’s authority. These early forms of fiat money were used in regions where carrying metal coins was impractical due to the size and weight. This system was largely local, but it laid the groundwork for a more widespread adoption of fiat money centuries later.

For most of history, money was backed by physical commodities like gold or silver, which had intrinsic value. This system was known as the gold standard. Under the gold standard, currencies were tied to a fixed amount of gold, meaning that governments could only issue as much currency as they had gold reserves. This limited the amount of money in circulation and prevented runaway inflation, as governments couldn’t simply print money whenever they wanted.

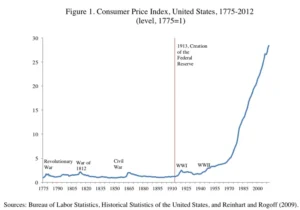

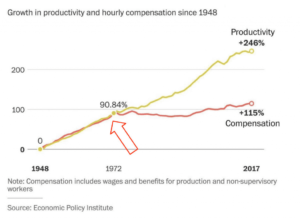

The final break from the gold standard occurred in 1971 when President Richard Nixon took the U.S. off the gold standard completely, a move known as the “Nixon Shock.” This decision marked the full transition to a fiat currency system for the U.S. and most of the world. With fiat money, governments no longer needed to be concerned with gold reserves or commodity supplies. Instead, the value of money was determined by the trust in the issuing government and its economy. This gave governments the ability to respond to economic crises more effectively, but it also opened the door to a new set of economic challenges, the most significant being inflation.

The shift to fiat money was revolutionary, but it wasn’t without consequences. While it gave governments the flexibility to manage economic cycles through the manipulation of money supply, it also removed the checks and balances provided by the gold standard. Governments now had the ability to print money at will, and with this power came the potential for inflationary pressures to build. The history of fiat money is, in many ways, a history of trying to balance the need for economic growth with the need to control inflation.

As nations transitioned away from the gold standard, they found that the new fiat money system came with a double-edged sword. On one hand, it allowed for more economic freedom and expansion. On the other hand, it created the opportunity for unchecked inflation, which could erode the value of money, disrupt economies, and harm citizens. This dynamic would become one of the central concerns of modern economics and continue to shape monetary policy discussions to this day.

Fiat money has now become the norm in most of the world. However, the legacy of the gold standard still influences how people think about currency. The idea that money should be tied to something tangible and limited, like gold, is deeply ingrained in the global financial psyche. But as fiat currencies dominate, inflation has become an unavoidable side effect that must be carefully managed by central banks.