Lesson 8: The Mechanics of Inflation

Inflation is the persistent rise in the prices of goods and services over time, which, in turn, reduces the purchasing power of money. In the context of fiat money, inflation occurs when the money supply increases faster than the growth of the economy. To understand this, it’s crucial to grasp the basic dynamics of inflation. When more money is introduced into an economy, the value of each individual unit of currency declines. If the supply of money increases but the amount of goods and services available remains the same, prices rise.

At the heart of inflation is the relationship between supply and demand. Money, like any other good or service, operates within the laws of supply and demand. When there is an excess of money in circulation, people are willing to pay more for the same goods, driving prices higher. The more money that is available, the less value each dollar has, and this is reflected in rising prices.

Inflation is often seen as a natural byproduct of economic growth, but the relationship between inflation and economic expansion is not always straightforward. When the economy grows, the demand for goods and services increases, which can push prices up. However, if the money supply grows too quickly without a corresponding increase in production, inflation can spiral out of control. This is the delicate balance that central banks attempt to manage through monetary policy.

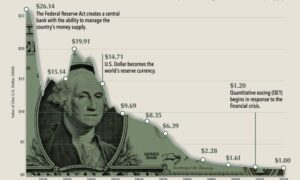

Central banks have several tools at their disposal to control inflation. One of the primary methods is through adjusting interest rates. When central banks raise interest rates, borrowing becomes more expensive, which reduces consumer spending and slows down economic activity. This can help prevent inflation from rising too quickly. On the other hand, when interest rates are lowered, borrowing becomes cheaper, and people and businesses are more likely to spend and invest, stimulating the economy.

Another tool central banks use is open market operations, which involve buying or selling government bonds in the open market. By buying bonds, central banks inject money into the economy, increasing the money supply. Conversely, selling bonds takes money out of circulation, reducing the money supply. Through these tools, central banks try to regulate the economy, ensuring that inflation stays within manageable levels.

Quantitative easing (QE) is another tool that has been used more recently, especially during economic crises. QE involves the central bank purchasing large quantities of government bonds or other financial assets to increase the money supply. This method is often used when interest rates are already low and cannot be lowered further. By increasing the money supply through QE, central banks aim to stimulate economic activity and avoid deflation, which can be just as damaging as inflation.

Inflation is often measured by tracking the price changes in a basket of goods and services, known as the Consumer Price Index (CPI). The CPI is a commonly used gauge to track inflation and give policymakers an idea of how prices are moving in the economy. However, the CPI is not a perfect measure, as it does not account for all goods or services in the economy, and it can be influenced by changes in the quality or composition of the items in the basket.

The causes of inflation can be broadly categorized into two types: demand-pull inflation and cost-push inflation. Demand-pull inflation occurs when there is an increase in demand for goods and services, which outpaces supply, causing prices to rise. This is often seen in a growing economy where consumer confidence is high, and spending increases. Cost-push inflation, on the other hand, occurs when the cost of production increases, leading businesses to raise prices to maintain their profit margins. This can be caused by rising wages, higher raw material costs, or supply chain disruptions.

Despite the best efforts of central banks to manage inflation, it is an unpredictable and often volatile force. The complex interplay between the money supply, economic growth, and external factors like oil prices or geopolitical events makes inflation difficult to control. This unpredictability means that even small increases in inflation can have significant consequences for households, businesses, and governments.

Understanding inflation is critical because it has far-reaching effects beyond the price of goods and services. Inflation can erode savings, disrupt investment, and impact wage growth. It is a primary concern for policymakers, who must find ways to maintain a stable monetary environment while avoiding the potential downsides of inflation. The more money that is printed, the higher the risk of inflation, and finding a balance between stimulating economic growth and keeping inflation in check is one of the central challenges of modern economic policy.