Lesson 9: The Dangers of Inflation and It’s Impact on Society

While inflation can seem like an abstract concept, it has profound consequences for individuals, businesses, and entire societies. The most direct and visible effect of inflation is the erosion of purchasing power. As prices rise, the real value of money falls. This means that people can no longer buy the same amount of goods and services with the same amount of money. This impact is particularly harsh for people living on fixed incomes, such as retirees or those with low wages. Their income doesn’t increase with inflation, but the cost of their everyday needs does, leading to a decrease in their standard of living.

Inflation also discourages saving. If people expect prices to rise over time, they may feel that there is little point in saving money because it will be worth less in the future. This leads to a reduction in savings rates, which in turn can harm investment and slow down economic growth. When people stop saving, they stop providing the capital necessary for businesses to invest in new projects, expand their operations, and hire new workers.

For businesses, inflation presents significant challenges. When the cost of raw materials, labor, and other inputs rises due to inflation, companies may struggle to maintain profitability. This can lead to higher prices for consumers, which can further fuel inflation, creating a feedback loop. Businesses may also face uncertainty about the future, making long-term planning and investment more difficult. If inflation is high and unpredictable, businesses may be less willing to take risks, as they cannot be sure that their investments will yield a return that outpaces inflation.

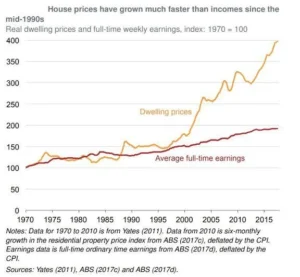

The social impact of inflation can also be significant. When prices rise, social inequalities tend to widen. Those who are wealthy and own assets like real estate, stocks, or commodities may see their wealth grow as the value of money falls. However, those without assets are left behind, struggling to keep up with rising costs. Inflation thus exacerbates income inequality, making the rich richer and the poor poorer.

Hyperinflation is the most extreme and devastating form of inflation. It occurs when prices increase at an astronomical rate, often by double or triple digits every month. In hyperinflationary environments, money becomes practically worthless. People are unable to afford basic necessities, and the economy grinds to a halt. Hyperinflation has occurred in several countries throughout history, with perhaps the most notable example being Zimbabwe in the 2000s, where the country experienced inflation rates exceeding 79 billion percent in a single month. In such environments, the value of money evaporates so quickly that people resort to bartering or using foreign currencies.

The political consequences of inflation can be just as severe as the economic ones. When people are unable to afford the basics due to rising prices, they become frustrated with their governments. This frustration can lead to protests, strikes, and in extreme cases, regime change. In countries with high inflation or hyperinflation, political instability often follows, as citizens lose confidence in the ability of their leaders to manage the economy. The erosion of trust in the currency and the government can destabilize entire nations.

Inflation also affects international trade. Countries with high inflation see their currencies lose value relative to other currencies, making their goods and services more expensive on the global market. This can reduce exports and create trade imbalances. Conversely, countries with stable or low inflation may see their currency appreciate, making their goods more competitive in international markets. This dynamic can lead to economic tensions between countries, particularly when inflationary pressures in one nation spill over into others.

Inflation is not just an economic issue—it is a social, political, and psychological issue as well. People’s perceptions of inflation can shape their behavior and attitudes toward money. When inflation is high, people may begin to lose faith in their currency, opting for alternative forms of money or assets, such as gold or cryptocurrency. This shift away from fiat money can further exacerbate inflation, as confidence in the currency diminishes.

Understanding the dangers of inflation is crucial for anyone involved in the global financial system. It is not just an abstract economic theory—it has real-world implications for people’s lives. Inflation affects everything from the cost of living to the stability of governments. It is a reminder of the power and responsibility that comes with controlling the money supply. The challenge for policymakers is to manage inflation in such a way that it remains stable enough to foster economic growth without letting it spiral out of control.