Lesson 18: The Dangers of Continuing on the Fiat Path

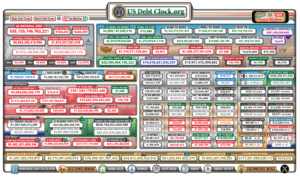

The growing global debt crisis is an ominous shadow hanging over economies worldwide. For decades, nations have relied on debt-driven economic growth, borrowing to finance public spending, often exceeding the capacity to repay. While this might appear manageable in the short term, the long-term implications of this approach are far more severe. As governments print more money to cover their debt obligations, the purchasing power of their currencies steadily declines, leading to inflation. This cycle can snowball as more debt is incurred to cover mounting deficits, ultimately creating a situation where the value of the currency becomes increasingly unstable. Countries trapped in this cycle may reach a tipping point where the debts become unsustainable, leaving them unable to service their obligations without resorting to even more drastic measures, such as hyperinflation.

Hyperinflation is one of the most devastating consequences of excessive money printing. When governments print money in large quantities to cover their debts, the currency rapidly loses value, leading to skyrocketing prices for basic goods and services. As this spiral accelerates, trust in the currency evaporates, and people begin seeking alternatives to store value, often turning to physical commodities, crypto or foreign currencies. In extreme cases, this loss of confidence can lead to a complete collapse of the currency, as seen in historical examples like Zimbabwe and Venezuela. These collapses are often accompanied by social and political unrest, as the financial system disintegrates and the economy plunges into chaos. The potential for hyperinflation in fiat-driven economies is not a theoretical concern—it’s a very real risk that increases with the continued expansion of global debt.

The risks of debt-driven economies extend beyond just inflationary pressures. As nations amass more debt, they become increasingly reliant on foreign creditors, which can lead to geopolitical tensions. Countries that find themselves deeply indebted to foreign powers may face economic and political pressure, reducing their autonomy in making monetary decisions. Moreover, unchecked inflation and currency printing can lead to societal breakdowns. The erosion of savings and purchasing power disproportionately affects the lower and middle classes, widening the wealth gap and fueling social unrest. In times of extreme inflation, the rich are often better equipped to protect their wealth through investments in real estate, stocks, or commodities, while the less affluent see their financial stability crumble. This growing inequality and instability pose a significant threat to social cohesion and long-term peace.