Real Challenges – And How Bitcoin Overcomes Them

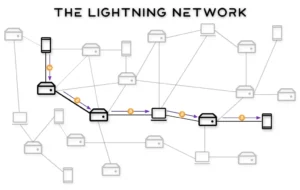

Let’s start with scalability—can Bitcoin handle the big leagues? Right now, the blockchain processes about 7 transactions per second. Compare that to Visa’s 24,000, and critics scoff, “It’ll never work for everyday stuff!” Fair point: if you’re buying coffee with BTC, you don’t want to wait an hour. But here’s the fix: the Lightning Network. Think of it like a turbocharged sidekick—transactions zip off-chain, instant and cheap, then settle on the blockchain later. It’s already live—folks in El Salvador use it to buy tacos—and it’s scaling up to millions of transactions per second. This means Bitcoin’s not just for HODLing; it’s becoming cash you can spend, fast and easy. Future tweaks, like bigger blocks or smarter tech, only sweeten the deal. Scalability’s a hurdle, but Bitcoin’s leaping it.

Next up: energy use. Mining’s a power hog—those computers solving puzzles guzzle electricity, and headlines scream, “Bitcoin’s boiling the planet!” Numbers vary, but estimates peg it at 100 terawatt-hours yearly—more than some small countries. Sounds bad, right? But let’s zoom out. Fiat’s no saint: the global banking system—ATMs, branches, servers—chews through 650 terawatt-hours annually, plus the hidden costs of cash printing, transport, and security. Gold mining? It’s a dirty 130 terawatt-hours, with toxic sludge to boot. Bitcoin’s leaner than that mess, and here’s the kicker: miners chase cheap, often renewable energy—think hydropower in Canada or solar in Texas. A 2023 report showed over 50% of mining’s now green-powered. This isn’t a deal-breaker; it’s a trade-off where Bitcoin’s upfront cost beats fiat’s sneaky, sprawling footprint.

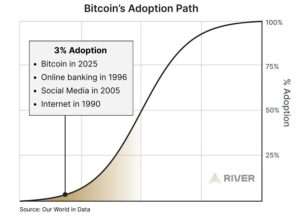

Then there’s adoption—why isn’t everyone using it yet? Truth is, Bitcoin’s young—just 16 in 2025—and it’s fighting a world hooked on fiat’s convenience. Only about 200 million people own BTC globally, a drop in the bucket next to billions with bank cards. Hurdles like tech know-how (wallets, keys) and old habits (swiping plastic) slow it down. But time and education are the cure. Look at the internet: in 1995, it was clunky and niche; by 2010, it was everywhere. Bitcoin’s on that arc—El Salvador’s made it legal tender, companies like Tesla have dabbled, and apps are getting simpler every day.

These challenges aren’t fluff—they’re real, and Bitcoin’s not dodging them. Scalability’s getting a Lightning boost, so your BTC can buy a sandwich, not just sit pretty. Energy use? It’s loud but cleaner than fiat’s quiet chaos—miners aren’t the villains banks are. Adoption’s slow, but it’s steady—time turns skeptics into HODLers. This isn’t a collapse waiting to happen; it’s a system growing up. That house we love? Lightning could let you pay for it in BTC, mined greener than fiat’s dirty dollars, as more people join the party. This lesson doesn’t sugarcoat—it shows Bitcoin’s grit, fixing flaws and forging a future we can bank on.

This is Bitcoin’s comeback story: real hurdles, real solutions. Scalability’s no match for tech like Lightning; energy’s a fair fight where fiat’s worse; adoption’s just a waiting game we’re winning. It’s hope with muscle—a system that’s not perfect yet, but already outshining the old guard for regular folks like us.