Securing the Network, Creating Scarcity

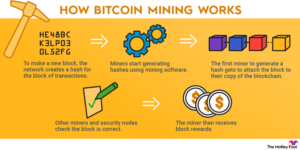

Let’s dive into Bitcoin mining—think of it like digging for digital gold, but instead of pickaxes, it’s computers racing to solve puzzles. Here’s the basics: miners are the muscle behind Bitcoin, doing two big jobs. First, they verify transactions—you send 0.5 BTC to a buddy, miners check it’s legit, then lock it into the blockchain so no one can fake it. Second, they “mint” new Bitcoin as a reward for their work, adding tiny bits to the total supply. It’s not some bank cranking out cash; it’s a global crew of regular folks with powerful rigs, competing to keep the network honest. For you—whether you’re buying coffee or saving for a house—this means every Bitcoin move is triple-checked, safe from scams or meddling hands. Mining’s the heartbeat of a system that doesn’t need a boss.

The supply isn’t endless. Satoshi Nakamoto, Bitcoin’s mysterious creator, baked in a limit—21 million coins, max—and mining’s how we get there, slow and steady. Every 10 minutes or so, miners crack a math problem—think Sudoku on steroids—and the winner gets freshly minted BTC. But the payout’s not random; it’s controlled by code. Start with this: back in 2009, a miner scored 50 BTC per win. Sounds sweet, right? But every four years, that reward halves—25 BTC in 2012, 12.5 in 2016, 6.25 in 2020, and so on. It’s called “the halving,” and it’s Bitcoin’s secret sauce for scarcity. Less new BTC trickles out over time, tightening the tap until, around 2140, it stops at 21 million. For everyday people, this is huge: your Bitcoin doesn’t get diluted like dollars at a printing press—it gets rarer, and that’s power in your pocket.

Let’s unpack the halving—it’s like nature’s way of saying, “Good things take time.” Picture a pie: at first, miners carve out big slices, but every four years, the slices shrink, forcing the pie to stretch further. By 2025, we’re down to 3.125 BTC per block, and the next halving in 2028 will drop it to 1.5625. Why’s this matter? Scarcity drives value. When supply slows but demand grows—say, more folks want BTC for payments or savings—each coin’s worth climbs. Think of that house again: if it’s 10 BTC today, a halving or two could mean it’s 5 BTC, then 2 BTC, not because houses crash, but because Bitcoin’s rarer and stronger. This isn’t just tech; it’s a ticket to wealth that fiat can’t touch, because fiat’s got no brakes, just printers on overdrive.

Miners aren’t just nerds in basements—they’re the backbone of a system that laughs at fiat’s flimsy promises. While banks churn out trillions—$6 trillion in the U.S. alone during 2020’s chaos—miners grind through complex math, securing Bitcoin with sweat and silicon. They’re like the night watchmen of a castle, keeping the gates shut against fraud, and their rewarded the new coins that keep the economy humming. But unlike fiat’s reckless flood, mining’s a disciplined dance—halvings ensure it’s a trickle, not a tsunami. This means Bitcoin’s built to last, not collapse under its own weight. Miners don’t just make BTC; they make it trustworthy.

Mining is more than a process—it’s Bitcoin’s shield and sword. It secures your transactions so no one can rip you off, and it creates scarcity so your stash grows tougher, not weaker. Miners are the unsung champs outlasting fiat’s printing presses, building a future where your money’s not a punching bag for inflation. It’s the nuts and bolts of why Bitcoin’s a rebellion we can win—one block, one halving, one miner at a time.