The 21 Million Cap – Bitcoin’s Secret Weapon

Bitcoin has a cap—21 million coins, hardwired into its DNA, and that’s it forever. No exceptions, no overrides, no “oops, we need more.” Satoshi Nakamoto coded this limit back in 2008, like a cosmic law etched in digital stone. Why’s that a big deal? Because scarcity is the secret weapon fiat wishes it had. While governments can print dollars or euros until the presses smoke—watering down your paycheck and jacking up the cost of milk—Bitcoin’s supply is locked tight. By around 2140, the last Satoshi (a tiny fraction of a BTC) will be mined, and that’s game over for new coins. For you—this means money that doesn’t bleed value; it’s a game-changer that puts power back in your hands.

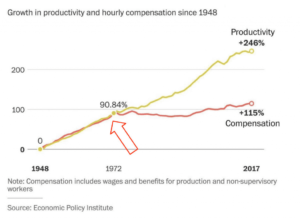

Contrast that with fiat, and it’s like night and day. Fiat’s got no ceiling—central banks can crank out cash whenever they want, and boy, do they. Take the U.S.: since 2020, trillions of dollars flooded the system, and what happened? Inflation hit, and suddenly your $20 grocery run costs $40. Back in 1971, when the dollar ditched gold, it lost over 85% of its punch—$1 then buys about 15 cents’ worth now. That’s infinite supply in action: more money chasing the same stuff, so prices soar and your savings shrink. Bitcoin’s 21 million cap is a finite pool—think of it like a rare whiskey, not a bottomless soda fountain. For regular folks, that’s a lifeline: your Bitcoin doesn’t get diluted by some suit hitting “print”; it holds its ground and then some.

Here’s where it gets juicy: scarcity plus demand equals fireworks. Bitcoin’s not just sitting there; it’s getting hotter—people buying it, businesses accepting it, even countries like El Salvador jumping in. With only 21 million BTC ever, and millions already HODLed or lost, the pie’s shrinking while the crowd’s growing. Basic economics kicks in: when something’s rare and wanted, its value shoots up. Look at early days—1 BTC was pennies in 2010; by 2021, it hit $60,000. Halvings (those supply cuts every four years) turbocharge this: less new BTC trickles out, so each coin’s worth more as demand climbs. That house we keep mentioning? Maybe 5 BTC today, but in 20 years, .01 BTC might do it—not because houses tank, but because Bitcoin soars. That’s the cap working its magic.

The bullish takeaway? HODLing’s your ace. Fiat punishes savers—stash $1,000 today, and in a decade, it might buy half a TV thanks to inflation. Bitcoin rewards patience: hold 1 BTC now, and as the world wakes up to its rarity, that 1 BTC could buy a house or more. It’s not gambling; it’s betting on a system where scarcity’s the rule, not the exception. For everyday people—this flips the script. Instead of racing to spend before your money’s worthless, you HODL and watch it grow. That’s not just wealth; it’s hope—hope that your hard work sticks around, not evaporates in a fiat flood.

The 21 million cap is Bitcoin’s knockout punch. It’s why fiat’s a leaky bucket and Bitcoin’s a steel vault. Scarcity’s the edge that makes Bitcoin a rebellion against a system that’s been bleeding us dry. HODLing’s not a fad; it’s a strategy, and with demand rising and supply capped, it’s a winning one. This is Bitcoin’s secret weapon, and it’s yours to wield.