The Big Picture – A Failing System and a New Hope

Let’s start with a scene most of us know too well: you check your bank account, and that nest egg you’ve been building feels smaller—not because you spent it, but because the world got more expensive overnight. Inflation’s the culprit, and it’s like a slow leak in your financial lifeboat. A gallon of gas that was $3 last year is $4 now; a $500 rent check from a decade ago wouldn’t cover a closet today. Meanwhile, wages creep up—if they move at all—while the cost of living sprints ahead. This isn’t just bad luck; it’s the fiat system doing what it’s designed to do: erode your money’s power while piling up debt for everyone but the elite. We’re pulling back the curtain on this mess and showing how Bitcoin lights a way out.

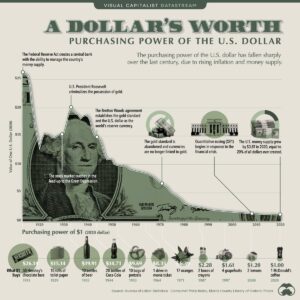

The numbers tell a grim story. In the U.S., for example, the dollar’s lost over 95% of its purchasing power since 1913, when the Federal Reserve kicked off centralized control of money. That means a buck your great-grandpa saved back then buys about a nickel’s worth of stuff today. And it’s not just history—look at the last few years: stimulus checks, money printing and suddenly your grocery cart costs 20% more. Who’s steering this ship? Banks and governments, calling the shots from glass towers, deciding when to flood the system with cash that dilutes what’s in your pocket. It’s a game where they hold the joystick, and we’re stuck scrambling to keep up. But here’s the kicker: it doesn’t have to be this way.

Enter Bitcoin—a total curveball to this centralized chaos. Unlike fiat, no one can crank up Bitcoin’s supply on a whim. It’s capped at 21 million coins, period, baked into its code like a law of nature. That scarcity is its superpower. While fiat floods the world and loses value, Bitcoin’s limited supply means it’s built to grow stronger as more people want in. Think of it like a rare baseball card: the fewer there are, the more each one’s worth. This teases a mind-blowing idea: what if, instead of needing a bigger pile of dollars every year to buy a house, you needed less Bitcoin? Picture a home costing 5 BTC today dropping to .5 BTC in a decade because Bitcoin’s value climbs while fiat flops. That’s the flip we’re talking about—a system where your money works for you, not against you.

This isn’t just about math; it’s about hope. The fiat system thrives on control—central banks tweaking interest rates, governments bailing out buddies, all while regular folks drown in rising debt. Bitcoin says, “Enough.” It’s decentralized, meaning no single overlord can mess with it. It runs on a network of computers worldwide, owned by no one and everyone, secured by tech that’s tougher to crack than a bank vault. For the average person—say, a teacher saving for retirement or a parent hustling for their kid’s future—this is a lifeline. It’s a chance to stop losing ground and start gaining it, to ditch a system that punishes thrift and rewards recklessness.

You feel the weight of what’s broken and now the thrill of what’s possible. Bitcoin isn’t just a nerdy experiment—it’s a response to a world where your dollar buys less coffee, less house and less freedom every year. It’s a new hope for anyone who’s ever felt cheated by the fine print of finance. Bitcoin’s scarcity could turn your savings into a growing asset, not a shrinking one. Holding it might be the smartest rebellion you ever join. Fiat’s failing us, but Bitcoin’s rising, and it’s here to rewrite the rules for everyday people like you and me.