The Blockchain – A Trust Machine

Imagine a giant notebook, one that’s shared across the planet, where every dollar you spend or save gets written down—permanently, transparently, and without anyone sneaking in to erase it. That’s the blockchain in a nutshell: a global ledger that tracks every Bitcoin transaction, open for anyone to see, but locked tight so no one can mess with it. It’s not stashed in some bank’s basement or a government vault; it lives on thousands of computers worldwide, updating in real time. This means your money’s story isn’t controlled by a single overlord. It’s a public record, but one you can rely on, because once it’s written, it’s set in stone.

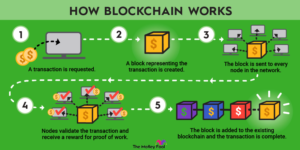

So, why’s this thing so bulletproof? Two big words: decentralization and cryptography. First, decentralization—there’s no head honcho running the show. Instead of a bank or a CEO holding the keys, the blockchain’s spread across a network of regular people’s computers (called nodes), from Seattle to Seoul. If one goes down, the rest keep humming; if someone tries to fake a transaction, the network sniffs it out and says, “Nope.” Then there’s cryptography—fancy math that scrambles every entry into a code tougher than a bank vault. Your Bitcoin’s tied to a private key only you have; without it, no one’s touching your stash. It’s like a digital fingerprint—unique, unbreakable, and yours alone. Together, this duo makes the blockchain a fortress: no hacking, no rewriting, just trust without a middleman.

Why does this matter to you? Think about the last time you worried about your money—maybe a bank fee stung you, or you heard about a hack draining accounts. In the fiat world, your cash sits in someone else’s hands, ripe for manipulation. A bank can freeze it, a government can devalue it, a glitch can wipe it out. The blockchain flips that script. Because it’s decentralized, no single jerk can pull the plug; because it’s cryptographic, no thief’s cracking it easily. Your Bitcoin’s safe not because some suit promises it, but because the system’s built to protect it—automatically, globally, always. This isn’t just tech; it’s your wealth dodging the traps of a shaky system.

Picture this in action: you send 0.1 BTC to your sister across the country. It hits the blockchain—bam, recorded forever. No bank delays, no “processing” excuses, just a straight shot, verified by the network in minutes. Nobody can go back and say it didn’t happen or skim a cut. This is freedom. It’s money that doesn’t bend to bailouts or bureaucrats. And that house we keep talking about? Whether it’s 5 BTC or 0.1 BTC years from now, the blockchain ensures your savings stay yours, untouchable by inflation’s greedy paws or a bank’s sticky fingers. Taking a peek under Bitcoin’s hood, the blockchain’s the trust machine that keeps it humming.

Blockchain is more than code—it’s your shield in a world where trust’s been torched. It’s why Bitcoin can promise a future where your money’s not a pawn in someone else’s game. This isn’t just how Bitcoin works—it’s how it saves us, locking our wealth in a system that’s tough, fair, and ours. It’s the nuts and bolts of a revolution, and you’re holding the wrench.