The Naysayers – What They Get Wrong

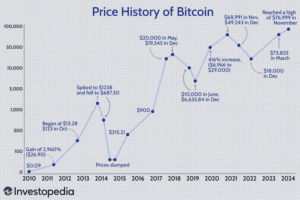

Bitcoin’s got haters—plenty of them—and they love to shout from the rooftops: “It’s too volatile!” Picture the headlines: BTC rockets to $60,000, then dips to $30,000, and the naysayers cackle, “See? It’s a rollercoaster!” Sure, those swings look wild if you’re staring at a price ticker every day, but here’s the catch: for long-term HODLers, they’re just noise. Zoom out—way out. In 2011, Bitcoin was $1; by 2021, it hit tens of thousands. Those dips? Blips on a climb that’s crushed every asset in the game. It’s not about cashing out tomorrow; it’s about holding a scarce gem that grows over decades. Volatility’s a short-term scare; HODLing’s a long-term win. That house we talk about? Whether it’s 5 BTC today or .01 BTC in 20 years, the dips don’t dent the destination.

Then there’s the classic: “It’s not backed by anything!” Oh, this one’s rich. Critics smirk, “Where’s the gold? The government stamp?” But let’s flip the mirror—fiat’s “backing” is what, exactly? A promise from politicians who print trillions when the mood strikes? The dollar ditched gold in 1971, and now it’s just paper with faith—and that faith’s crumbling. Bitcoin’s got something fiercer: math and network strength. Its 21 million cap’s coded in, unchangeable, and it runs on a global web of computers no one can shut down. That’s not “nothing”—it’s physics meets grit, a system tougher than any bank vault. This beats fiat’s hot air: your BTC’s backed by rules that don’t bend, not whims that break.

And the big one: “It’s for criminals!” You’ve heard it—Bitcoin’s the dark web’s darling, right? Time to bust that myth with cold, hard facts. Sure, some crooks use BTC—its privacy’s a draw—but fiat’s the real kingpin of crime. The UN estimates $1.6 trillion in dirty money flows yearly, mostly in cash—dollars, euros, you name it. A 2019 study pegged Bitcoin’s illicit use at under 1% of transactions, while cash hides in drug deals and tax scams daily. Banks like HSBC have laundered billions in fiat with a slap on the wrist; Bitcoin’s blockchain, meanwhile, tracks every move forever—hardly a crook’s dream. This is noise: BTC’s no more “criminal” than the $20 in your wallet, and fiat’s the bigger bandit.

These naysayers aren’t just wrong—they’re stuck in the past. Volatility? A distraction for HODLers watching BTC climb over years, not hours. No backing? Bitcoin’s got math and muscle fiat can only dream of. Crime? Fiat’s the heavyweight champ there, not BTC. This is your shield against the doubters—proof that Bitcoin’s not the problem; it’s the fix. The critics see a wild stallion; HODLers see a rocket. That house dropping from 5 BTC to 1 BTC? That’s not a flaw—it’s the future, and the naysayers are missing the ride.

These aren’t weaknesses—they’re strengths the old guard can’t grasp. It’s a rallying cry for regular folks fed up with fiat’s lies—volatility fades, math holds, and crime’s a fiat specialty. Bitcoin’s not perfect, but it’s built for us, not them, and that’s what the naysayers get wrong every time.