It’s February 2025, and Bitcoin has been hovering around $100,000 for the past two months. Historically, the post-halving year has been extremely bullish, and February has often marked the start of major price rallies. But this time, it’s different. Despite reduced supply from the halving and strong demand from ETFs, Bitcoin seems stuck.

So, what’s going on? Shouldn’t the halving supply shock have kicked in by now? Are whales like BlackRock manipulating the price to keep accumulating? Let’s break it all down.

The Halving Supply Shock Takes Time

One of the biggest misconceptions about the Bitcoin halving is that it leads to an immediate price surge. In reality, while the halving reduces new supply, its effects aren’t felt overnight. Here’s why:

- Miners still have reserves – Bitcoin miners don’t sell all their coins immediately, meaning supply doesn’t dry up right away.

- Market absorption takes time – The reduced issuance of Bitcoin must be felt in the broader market before price reacts.

- Historical trends show delayed moves – Looking at past cycles, the real parabolic moves didn’t start immediately after the halving but rather months later.

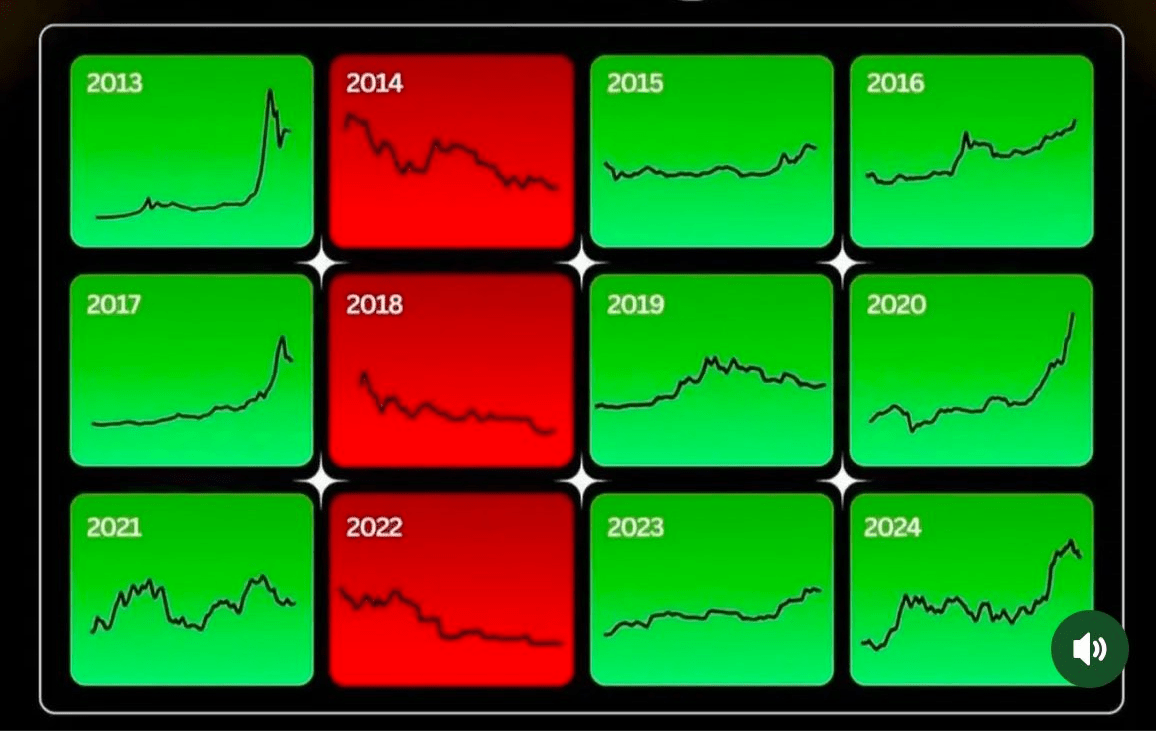

Let’s take a look at how this played out in past cycles:

- 2013 Cycle: The real breakout happened in Q4, not right after the halving.

- 2017 Cycle: Bitcoin had a strong start but went fully parabolic much later in the year.

- 2021 Cycle: February was strong, but the true mania phase came later.

In other words, Bitcoin follows a pattern, but the timing can vary slightly. The post-halving supply shock is real, but it typically takes months for the price to react.

The Buyers vs. Sellers Dynamic

Bitcoin’s price is ultimately dictated by the balance between buyers and sellers. Right now, we know that:

✅ Demand is increasing – ETFs are bringing in institutional investors, adoption is growing, and spot buying remains strong.

❌ Supply is tightening – Miners are earning less, and long-term holders are reluctant to sell.

So why isn’t Bitcoin surging yet? The answer lies in how big players accumulate.

Are Whales Like BlackRock Suppressing the Price?

Many investors suspect that institutions like BlackRock are intentionally keeping Bitcoin under $100,000 to accumulate more before the real rally begins. While this might sound like a conspiracy theory, there’s actually some logic behind it.

Big players don’t buy like retail investors. Instead of chasing green candles, they accumulate slowly and strategically to get the best price. Here’s how they do it:

- Algorithmic trading – Automated systems buy Bitcoin in a way that keeps price movements minimal.

- Selling into their own bids – Large institutions might sell Bitcoin to themselves at key levels to create a price ceiling.

- Fake sell walls – Orders placed on exchanges that make it look like there’s heavy resistance, scaring off smaller buyers.

This kind of accumulation strategy isn’t illegal—it’s just how professional traders and institutions operate in all financial markets.

Why Isn’t February as Bullish as Expected?

Historically, February has been a strong month for Bitcoin, so why is 2025 different? There are a few unique factors at play:

- The ETF factor: This is the first cycle with U.S.-regulated Bitcoin ETFs, and institutions accumulate differently than retail traders. Instead of FOMO-buying, they slowly build positions over time.

- Macroeconomic conditions: Interest rate cuts, which could fuel further Bitcoin demand, haven’t happened yet.

- Leverage reset: If too many traders use leverage too soon, it can delay the breakout before the real move happens.

While February has often marked the start of Bitcoin’s biggest moves, no two cycles are exactly alike. The ETF era introduces a new variable, meaning we may need to be more patient.

When Will Bitcoin Finally Break Out?

If history is any guide, we should expect major moves in Q2 or Q4 2025.

- Q2: March-April is a key period to watch. If Bitcoin doesn’t start moving by then, something unusual is happening.

- Q4: In past cycles, the most explosive growth has happened in the second half of the post-halving year.

The good news? The longer Bitcoin consolidates at high levels, the stronger the breakout will likely be when it finally happens.

Final Thoughts

Bitcoin’s delayed breakout might be frustrating, but it’s not unexpected. The halving supply shock takes time to play out, and institutional accumulation is likely keeping the price range-bound for now.

If ETFs continue to see inflows and supply keeps tightening, a massive rally is still coming—just a bit later than expected.

So the real question is: Are you ready when it happens?